GULF SHORES, AL – When and if a vote comes on a Special Tax District in the Gulf Shores High School feeder pattern, citizens who are residents of the district will contribute 22 percent of the …

This item is available in full to subscribers.

Please log in to continue |

GULF SHORES, AL – When and if a vote comes on a Special Tax District in the Gulf Shores High School feeder pattern, citizens who are residents of the district will contribute 22 percent of the total collection.

“For roughly every $1 homesteaded property owners put in, investment and second home and commercial property owners put in $4,” Kevin Corcoran of the Education Advisory Task Force said.

Some of those same citizens paying the proposed 3 mills on the homes they live in will also be some of those who own other properties making up 78 percent of collections on the proposed new levy.

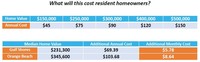

The average cost to homeowners in Gulf Shores would be about $70 annually and in Orange Beach the extra millage would average about $104 per years.

This is just one of the many facts Education Advisory Task Force members Corcoran of Gulf Shores and Doug Warren and Jim Caldwell of Orange Beach are putting forth in a presentation.

They have been to councils, schools and civic groups all over the island seeking support to have a vote on levying a 3 mill tax in the feeder pattern. The deadline was missed for the Nov. 8 when the Orange Beach City Council balked when the task force asked for a resolution of support to place the tax on the ballot.

Organizers are now hoping for a spring special election for voters to decide. The district runs from Ono Island on the east to Fort Morgan on the West with the basic northern boundary being County Road 8.

Another fact that may be Corcoran’s favorite fact, besides citizens putting up $1 and getting a $4 match from business interests and out-of-town owners, is the return on the investment.

“The beauty of this scenario is where the tax is generated is where it will be spent,” Corcoran said. “When we were going to do the 8 mills, we were going to get a $35 million high school out of a $350 million project, about 10 percent of it. We would get back .8 mills, roughly, after paying 8 mills.

“Now we’re going to put in 3 mills and we’re going to keep all three.”

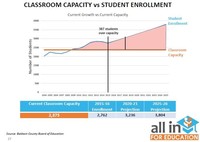

There are naysayers in other parts of the county who say the new buildings and curriculum will mean their schools will fall behind those in the special districts.

“I think it will create and inequitable education situation in the county,” David Cox, the school board member for District 1, said. “They will have so much money to do what they want to do. That part is great and wonderful, but it’s going to leave the rest of the county behind and that’s why I opposed it.”

But Corcoran says if the island tax is passed and schools are built here, it will relieve the county’s infrastructure burden here and give them more leeway to help the rest of the county.

“It’s a win-win,” he said. “Elberta doesn’t lose, Robertsdale doesn’t lose, Bay Minette doesn’t lose. And when there is money available it will go there because we have saved our own capital burden. We will have taken that burden off the board of education’s checkbook.

“So when they do get capital money and come to us and ask what we need, we can say we built it last year. Spend it in Elberta, spend it in Robertsdale, spend it in Bay Minette where the citizens aren’t supporting tax initiatives for education. So nobody loses here. It’s a win-win.”

Corcoran says each time the presentation is made, it changes a bit.

“We do not have all the answers by any means,” he said. “When people ask questions about how this will be handled and how that will be handled, all those questions aren’t answered yet, but we’re very interested in a cooperative effort to make it happen.”

There are, however, some hard facts noted in the presentation, Warren said.

“We do have all answers necessary for people to say this is a decision that must be made and made affirmatively,” he said. “How it all plays in the end, we don’t know that. But the facts will speak to the fact that there is no other option. We do know that.”